Statistiche di base

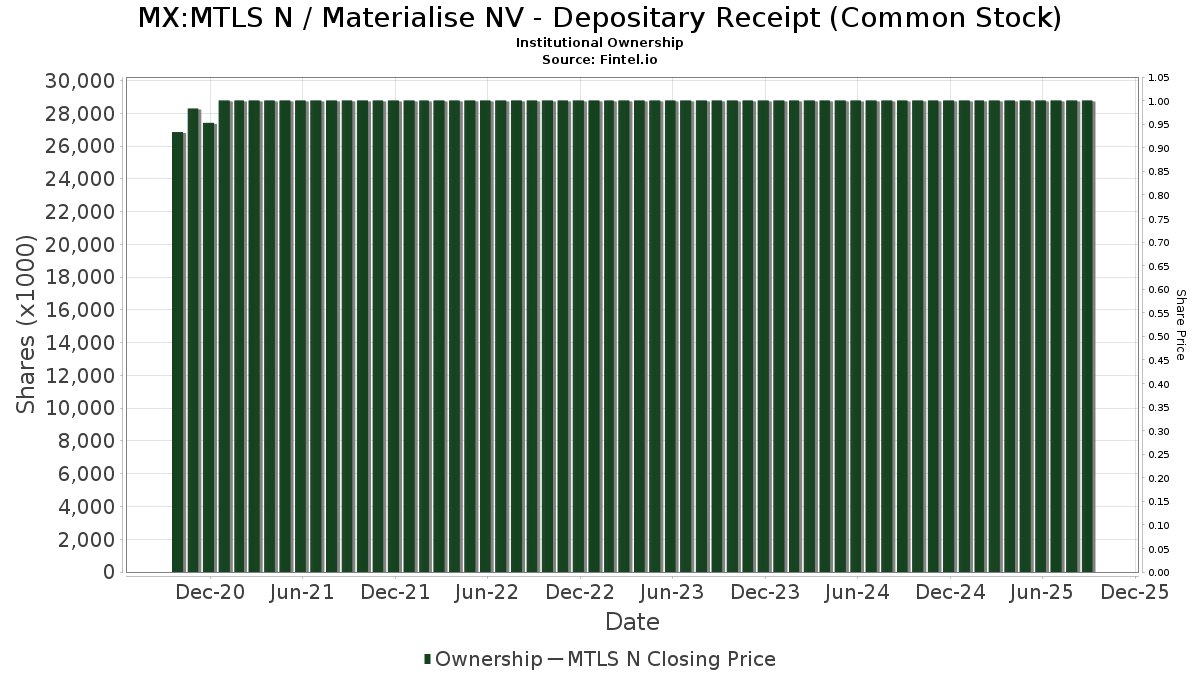

| Proprietari istituzionali | 72 total, 67 long only, 0 short only, 5 long/short - change of 10,96% MRQ |

| Allocazione media del portafoglio | 0.3765 % - change of 6,20% MRQ |

| Azioni istituzionali (Long) | 8.732.934 (ex 13D/G) - change of 1,93MM shares 7,18% MRQ |

| Valore istituzionale (Long) | $ 44.769 USD ($1000) |

Proprietà istituzionale e azionisti

Materialise NV - Depositary Receipt (Common Stock) (MX:MTLS N) ha 72 proprietari istituzionali e azionisti che hanno presentato i moduli 13D/G o 13F alla Securities Exchange Commission (SEC). Queste istituzioni detengono un totale di 8,732,934 azioni. I maggiori azionisti includono Disciplined Growth Investors Inc /mn, Rock Point Advisors, LLC, PRNT - The 3D Printing ETF, King Luther Capital Management Corp, ARK Investment Management LLC, Acadian Asset Management Llc, Arrowstreet Capital, Limited Partnership, Wells Fargo & Company/mn, Renaissance Technologies Llc, and Renaissance Group Llc .

(Materialise NV - Depositary Receipt (Common Stock) (BMV:MTLS N) la struttura proprietaria istituzionale mostra le attuali posizioni nella società da parte di istituzioni e fondi, nonché le ultime variazioni nella dimensione della posizione. I principali azionisti possono essere singoli investitori, fondi comuni, hedge fund o istituzioni. L'allegato 13D indica che l'investitore detiene (o ha detenuto) più del 5% della società e intende (o intendeva) perseguire attivamente un cambiamento nella strategia aziendale. L'allegato 13G indica un investimento passivo superiore al 5%.

Indice del sentiment dei fondi

L'indice del sentiment dei fondi (anche noto come "indice di accumulo di proprietà") individua i titoli più acquistati dai fondi. È il risultato di un sofisticato modello quantitativo multi-fattore che identifica le società con i più alti livelli di accumulo istituzionale. Il modello utilizza una combinazione dell'aumento totale dei proprietari dichiarati, delle variazioni nelle allocazioni di portafoglio di tali proprietari e di altre metriche. Il punteggio varia da 0 a 100: i numeri più alti indicano un livello di accumulo superiore ad altre società, mentre 50 rappresenta la media.

Frequenza di aggiornamento: giornaliera

Consulta Ownership Explorer per visualizzare l'elenco delle aziende con il ranking più alto.

Depositi 13F e NPORT

Le informazioni relative ai depositi 13F sono gratuite. Per accedere alle informazioni relative ai depositi NP è necessario un'abbonamento premium. Le righe verdi indicano le nuove posizioni. Le righe rosse indicano le posizioni chiuse. Fai clic sull'icona del link per visualizzare la cronologia completa delle transazioni.

Esegui l'upgrade

per sbloccare i dati premium ed esportarli in Excel ![]() .

.

| Data di deposito | Fonte | Investitore | Tipo | Prezzo medio (Stima) |

Azioni | Δ Azioni (%) |

Valore dichiarato ($ 1000) |

Δ Valore (%) |

Allocazione del portafoglio (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 34 | 0 | ||||||

| 2025-04-10 | 13F | Retireful, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Cubist Systematic Strategies, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-01 | 13F | Ballentine Partners, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Aperture Investors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | MAKX - ProShares S&P Kensho Smart Factories ETF | 3.235 | 170,03 | 17 | 112,50 | ||||

| 2025-07-16 | 13F | Randolph Co Inc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | King Luther Capital Management Corp | 580.000 | 19,59 | 3.277 | 37,34 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 17.527 | 0,00 | 99 | 15,12 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 53.518 | -13,25 | 288 | -11,11 | ||||

| 2025-05-14 | 13F | Trexquant Investment LP | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 5.103 | 5,63 | 29 | 21,74 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 49 | 81,48 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 60 | 0,00 | 0 | |||||

| 2025-05-14 | 13F | Credit Agricole S A | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 5.575 | -61,09 | 31 | -55,71 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 77.714 | -3,92 | 439 | 10,58 | ||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 12.995 | 0,00 | 73 | 15,87 | ||||

| 2025-08-14 | 13F | Axa S.a. | 126.066 | 0,00 | 712 | 14,84 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 843 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 4.231 | -48,38 | 24 | -42,50 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 24.890 | -74,87 | 0 | |||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 502.640 | -2,93 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 30.700 | -10,23 | 173 | 2,98 | |||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 54 | -65,82 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 28.993 | -46,09 | 164 | -38,26 | ||||

| 2025-08-14 | 13F | Rock Point Advisors, LLC | 981.515 | 9,28 | 5.546 | 25,51 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 48.500 | 80,97 | 274 | 109,16 | |||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 467.276 | 15,15 | 2.640 | 32,26 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 12.654 | 71 | ||||||

| 2025-08-28 | NP | SEEIX - Sit International Equity Fund - Class I | 6.532 | 37 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 11.650 | 1.453,33 | 66 | 2.066,67 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 49 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 58.259 | 79,30 | 329 | 106,92 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 26.066 | -0,37 | 147 | 14,84 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 13.031 | 19.063,24 | 74 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 150 | 0,00 | 0 | |||||

| 2025-05-12 | 13F | EAM Global Investors LLC | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Trading LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 44.915 | -21,98 | 254 | -10,60 | ||||

| 2025-08-13 | 13F | Archon Capital Management LLC | 67.583 | 382 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 207.382 | -13,62 | 1.172 | -0,85 | ||||

| 2025-03-25 | NP | EAISX - Parametric International Equity Fund Investor Class | 9.400 | -38,56 | 79 | -13,33 | ||||

| 2025-08-08 | 13F | KBC Group NV | 212.932 | -0,68 | 1 | 0,00 | ||||

| 2025-08-28 | NP | SPDW - SPDR(R) Portfolio Developed World ex-US ETF | 8.595 | 2,11 | 49 | 17,07 | ||||

| 2025-05-15 | 13F | Millennium Management Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 25.900 | 146 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 96.400 | -66,86 | 545 | -61,98 | |||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 67.084 | 103,42 | 379 | 133,95 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 74.500 | 5,97 | 421 | 21,74 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 19.700 | -67,33 | 111 | -62,50 | |||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 314.300 | 0,06 | 1.776 | 14,89 | ||||

| 2025-07-25 | 13F | Meritage Portfolio Management | 81.221 | 459 | ||||||

| 2025-08-14 | 13F | Bnp Paribas | 375 | 2 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 149.783 | 7,44 | 846 | 23,50 | ||||

| 2025-08-06 | 13F | Baillie Gifford & Co | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 130 | 0,00 | 1 | |||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-08 | 13F | Quintet Private Bank (Europe) S.A. | 1.700 | 0,00 | 10 | 12,50 | ||||

| 2025-04-22 | NP | GINN - Goldman Sachs Innovate Equity ETF | 9.868 | 52 | ||||||

| 2025-08-28 | NP | NDOW - Anydrus Advantage ETF | 8.820 | 18,29 | 50 | 36,11 | ||||

| 2025-06-26 | NP | OWSMX - Old Westbury Small & Mid Cap Strategies Fund | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-06-27 | NP | HAOSX - Harbor Overseas Fund Institutional Class | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-29 | 13F | Truist Financial Corp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 117.014 | -22,99 | 661 | -11,51 | ||||

| 2025-05-09 | 13F | Deutsche Bank Ag\ | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 17.527 | 0,00 | 94 | 2,17 | ||||

| 2025-06-25 | NP | PRNT - The 3D Printing ETF | 615.580 | 28,92 | 3.164 | -20,92 | ||||

| 2025-08-14 | 13F | Disciplined Growth Investors Inc /mn | 1.890.920 | 0,83 | 10.684 | 15,79 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 14.764 | 0,00 | 0 | |||||

| 2025-05-13 | 13F | Sei Investments Co | 25.670 | 0,00 | 181 | 0,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Peak6 Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Fmr Llc | 6.673 | 0,00 | 38 | 15,63 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 600 | -97,63 | 0 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 34.000 | -3,13 | 0 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100,00 | 0 | |||||

| 2025-06-03 | 13F | CWM Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Capital LLC | 26.609 | 150 | ||||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Logan Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 349.297 | -0,28 | 1.974 | 14,51 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Edmond De Rothschild Holding S.a. | 200.007 | 0,00 | 1.130 | 14,84 | ||||

| 2025-08-29 | NP | WMMAX - Teton Westwood Mighty Mites Fund Class A | 10.000 | 0,00 | 56 | 14,29 | ||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 81 | 0,00 | 0 | |||||

| 2025-07-24 | NP | FCAJX - Fidelity Climate Action Fund Fidelity Advisor Climate Action Fund: Class A | 6.673 | 0,00 | 36 | 0,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-06-30 | NP | BULD - Pacer BlueStar Engineering the Future ETF | 2.199 | 53,03 | 11 | -8,33 | ||||

| 2025-08-08 | 13F | Candriam Luxembourg S.C.A. | 10.000 | 57 | ||||||

| 2025-07-28 | NP | QQQS - Invesco NASDAQ Future Gen 200 ETF | 8.011 | 31,61 | 43 | 34,38 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | AMH Equity Ltd | 207.661 | 88,78 | 1.173 | 116,82 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | C M Bidwell & Associates Ltd | 53 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Teton Advisors, Inc. | 10.000 | 0,00 | 56 | 14,29 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 2.039 | 39,09 | 12 | 57,14 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 4.140 | 0,00 | 23 | 15,00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 169.583 | 91,04 | 958 | 119,72 | ||||

| 2025-08-13 | 13F | Roubaix Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | ARK Investment Management LLC | 566.508 | 28,59 | 3.201 | 47,67 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 3.693 | 17,20 | 21 | 33,33 | ||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 33.271 | -38,72 | 188 | -29,96 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 17.271 | -1,57 | 98 | 12,79 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 80.300 | 454 | |||||

| 2025-07-29 | NP | FDLS - Inspire Fidelis Multi Factor ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-11 | 13F | Renaissance Group Llc | 236.879 | -11,42 | 1.338 | 1,75 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 19.407 | 27,80 | 110 | 47,30 |